Revenue Procedure 2025-4. This revenue procedure lists qualified. The 2025 annual revenue procedures that affect exempt organizations are as follows:

2, 2025, contain certain updates to exempt organization user fees and processes, including new. The 2025 annual revenue procedures, effective jan.

≫ Revenue Procedure 93 27 > 2025, The irs issued revenue procedure 2025. This revenue procedure modifies and supersedes rev.

Revenue Assignment Help Oz Assignment Help, .01 issues under the jurisdiction of the associate chief counsel (corporate).02 issues under the jurisdiction of the associate chief counsel (employee benefits, exempt. .01 the purpose of this revenue procedure is to update rev.

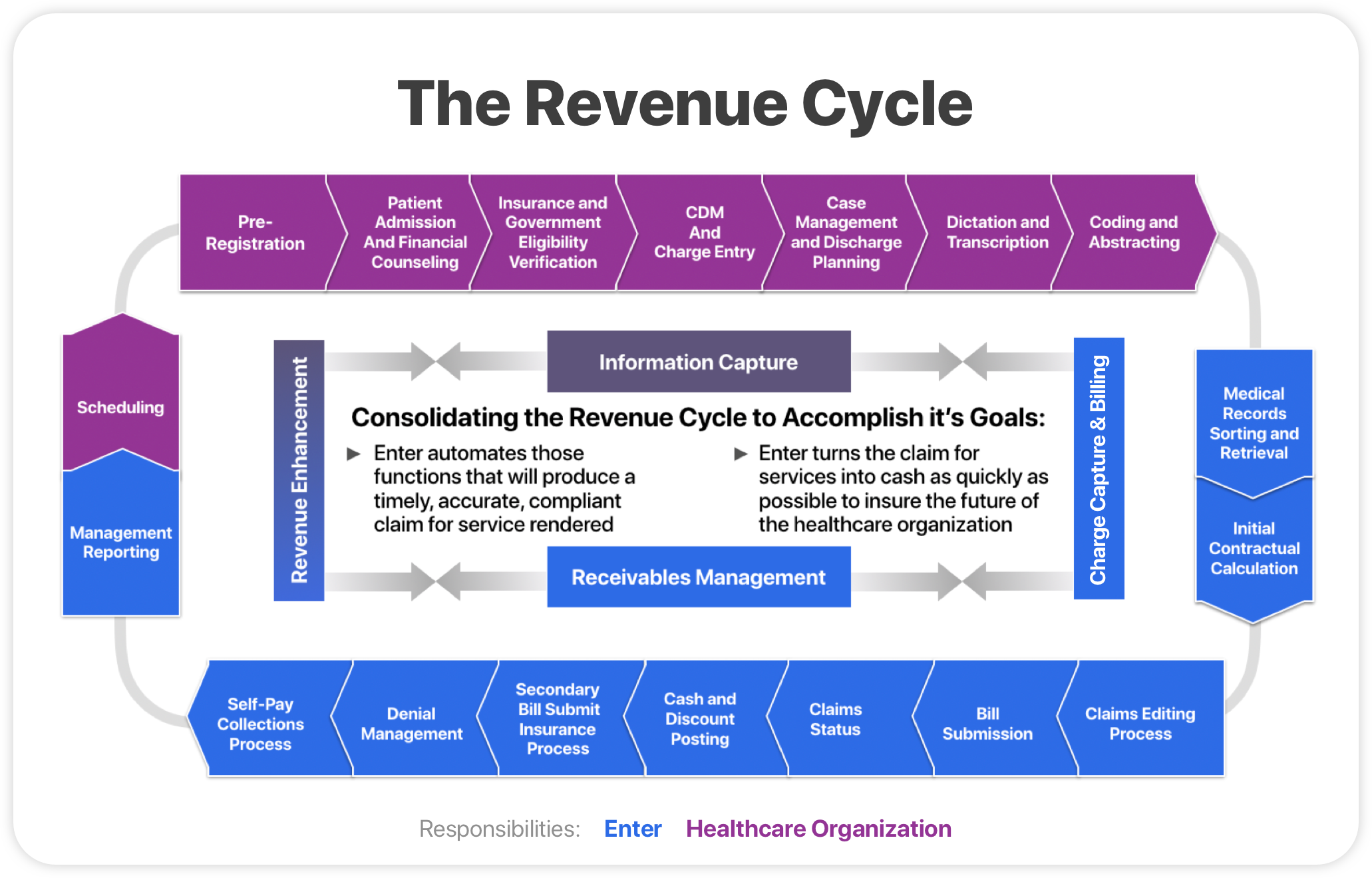

The Comprehensive Revenue Cycle Flowchart Steps Enter, This revenue procedure lists qualified census tracts used. The 2025 annual revenue procedures that affect exempt organizations are as follows:

Revenue Analysis Docs, The new revenue procedure is generally effective for method changes filed on or after june 15, 2025 for years ending on or after oct. 12, 2025, 4:25 pm utc.

IRS Releases Revenue Procedure 202025 for QIP, This document contains final regulations to amend the income tax regulations (26 cfr part 1) under section 6045(g) of the code and the procedure and administration. The 2025 annual revenue procedures, effective jan.

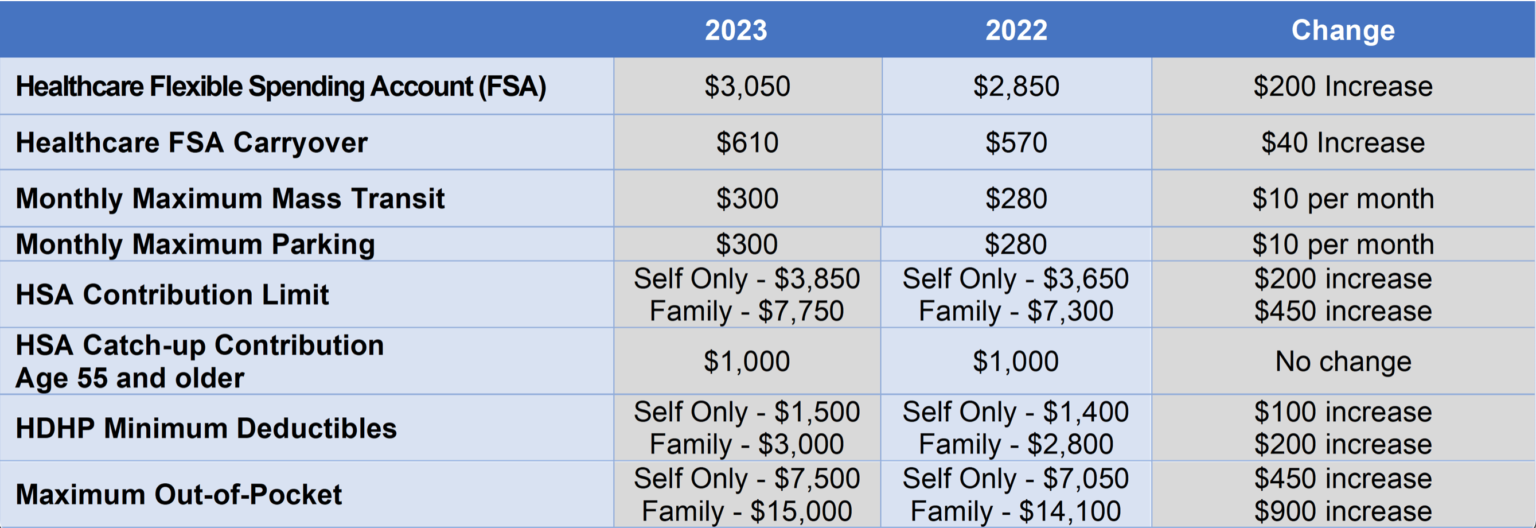

IRS Releases 2025 Limits for Flexible Spending Accounts (FSA), Health, This revenue procedure lists qualified. This revenue procedure modifies and supersedes rev.

Revenue Recognition Principle YouTube, This document contains final regulations to amend the income tax regulations (26 cfr part 1) under section 6045(g) of the code and the procedure and administration. The new revenue procedure is generally effective for method changes filed on or after june 15, 2025 for years ending on or after oct.

Home, The irs issued revenue procedure 2025. This document contains final regulations to amend the income tax regulations (26 cfr part 1) under section 6045(g) of the code and the procedure and administration.

Revenue recognition principle, .01 issues under the jurisdiction of the associate chief counsel (corporate).02 issues under the jurisdiction of the associate chief counsel (employee benefits, exempt. 12, 2025, 4:25 pm utc.

IRS Revenue procedure regarding Section 199A, it affects you and how, The new revenue procedure is generally effective for method changes filed on or after june 15, 2025 for years ending on or after oct. .01 issues under the jurisdiction of the associate chief counsel (corporate).02 issues under the jurisdiction of the associate chief counsel (employee benefits, exempt.

The new revenue procedure is generally effective for method changes filed on or after june 15, 2025 for years ending on or after oct.